New Will Emerges in Zappos Owner, Tony Hsieh, Estate Case

June 5, 2025

Protecting Young Influencers: How Trusts Can Safeguard Earnings in the Digital Age

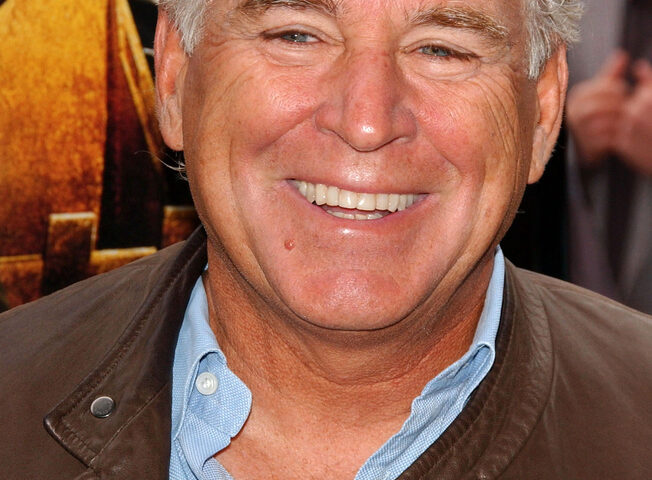

June 22, 2025The recent legal dispute involving Jimmy Buffett’s $275 million estate is a powerful reminder of how even the most thoughtfully crafted estate plans can lead to conflict if not managed with care, transparency, and trust. Buffett’s widow, Jane Buffett, has filed a lawsuit against Richard Mozenter, the Co-Trustee of the late singer’s Trust, accusing him of withholding vital financial information and behaving in a hostile, unprofessional manner during the administration process.

Jimmy Buffett, the beloved singer-songwriter and entrepreneur known for his laid-back lifestyle and hits like Margaritaville, passed away in September 2023. He and Jane were married for 46 years. According to court filings, the Trust in question was originally established in 1990 for Jane’s benefit and later amended in 2017 and 2023. Upon Buffett’s death, the majority of his assets were directed to a Marital Trust to be managed by Jane and an independent Co-Trustee, Richard Mozenter.

However, what was intended to be a secure financial future for Jane has reportedly turned into a prolonged battle for information and control. In her complaint, Jane asserts that Mozenter has failed to perform even the most basic tasks required of a Co-Trustee, such as providing updates on Trust assets and financial projections. Despite repeated requests, she claims she has been kept largely in the dark about her own finances.

The tension appears to have started early. Jane’s initial meeting with Mozenter, held a month after Buffett’s passing, offered little clarity about her expected income from the Trust. Over the following 16 months, she alleges Mozenter delayed and deflected any effort to provide answers. When he finally presented an income estimate earlier this year, the numbers were described as “shocking” and indicated less than $2 million in annual income on an estate worth $275 million.

According to the filing, this projection did not factor in income from key holdings, including Buffett’s lucrative Margaritaville brand, of which the Trust owns about 20%. Mozenter reportedly advised Jane to adjust her lifestyle or sell real estate, a suggestion that only deepened her concern and frustration.

Beyond financial transparency, Jane’s lawsuit accuses Mozenter of disrespectful and antagonistic behavior, including belittling her, refusing to collaborate effectively, and supporting legal counsel who has also acted unprofessionally. The complaint notes that Jane requested Mozenter resign as Co-Trustee, a request he has refused. Despite the conflict, he has allegedly continued to collect over $1.7 million in Trustee fees annually.

This high-profile legal battle sheds light on the importance of selecting trustworthy, communicative fiduciaries in estate planning, especially when vast wealth and family interests are involved. The legal duties of Trustees are not only fiduciary in nature but also deeply personal when surviving family members rely on their guidance.

A court hearing is scheduled for August 14. As the case unfolds, it will likely serve as a cautionary tale for families with complex estates.

At The Estate Planning & Legacy Law Center, we help ensure your estate plan reflects your wishes and provides clarity for you and your family. If you have questions about selecting Trustees or updating your estate plan, we’re here to help.