Estate Planning for New Parents

September 25, 2018What You Need to Know About Marriage and Estate Planning

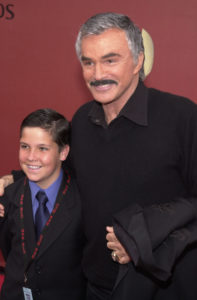

October 15, 20182018 has been marked by a series of high-profile celebrity deaths. Several of the deceased made news in estate planning circles because of a failure to plan for what would happen to their estates when they died. When Burt Reynolds died unexpectedly on September 6, 2018, he, fortunately, didn’t join this group of non-planners. However, news headlines less than two weeks after his death proclaimed that he had left his son out of his Will.

Does this mean that Reynolds and his 30-year old son, Quinton, had a falling out? Did the famous actor coldly exclude his son from inheriting any of his estimated $5 million fortune? Fortunately for Quinton, no. While he won’t inherit directly under his father’s Will, the Will specifically states that Reynolds provided for Quinton through a Trust.

Does this mean that Reynolds and his 30-year old son, Quinton, had a falling out? Did the famous actor coldly exclude his son from inheriting any of his estimated $5 million fortune? Fortunately for Quinton, no. While he won’t inherit directly under his father’s Will, the Will specifically states that Reynolds provided for Quinton through a Trust.

By using a Trust, Reynolds may have accomplished several estate planning goals. First, assets passing through the Trust pass outside of probate court. This eliminates much of the cost, hassle, and publicity that comes with such proceedings. People also often use Trust instruments for estate tax planning purposes, including provisions designed to maximize allowable exemptions.

And, while we will likely never know the details of how the Trust distributions for Quinton are structured in this case, it’s also possible that Reynolds provided for long-term management of Trust assets for his son. This type of provision is common, allowing people to, in effect, manage from beyond the grave. Trusts can be designed so that the named trustee has authority to make periodic distributions for the beneficiary’s health, education, maintenance, and support, make distributions for other predetermined reasons, make discretionary distributions, and distribute lump sums when the beneficiary reaches certain ages or after a certain number of years.

So, although Burt Reynolds did, in fact, leave his son out of his Will, that statement is somewhat misleading because he provided for him through his Trust. If you’d like to learn how a Will, a Trust, or a combination of tools can help you meet your estate planning goals, contact us today! No matter what your estate planning requirements may be, we will carefully listen and help you to create an estate plan that meets your wishes and needs.