What to Do if Your Spouse Writes a Secret Will

March 16, 2020Spike in Online Wills Due to COVID19- Lawyers Caution Some May Be Invalid

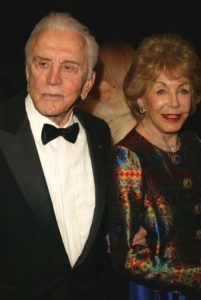

March 30, 2020Hollywood screen legend Kirk Douglas died on February 5, 2020, survived by his second wife and three sons including actor Michael Douglas. With an award-winning career spanning seven decades, Kirk Douglas had amassed a sizable fortune, estimated at $61 million, before his death at the age of 103. Unlike many notable celebrities who have died in recent years without having done any estate planning, it seems that Douglas did have the forethought to document his wishes for the disposition of his assets.

In a move that at first blush seems surprising, it seems that most of Douglas’ wealth — $50 million — will pass to a charity he and his wife, Anne, founded — The Douglas Foundation 1964. That private foundation, in turn, benefits several other non-profit organizations including the Children’s Hospital of Los Angeles, a St. Lawrence University scholarship for underprivileged students, and the Kirk and Anne Douglas Childhood Center, among others. His famous son, Michael, reportedly will receive nothing from the estate. Of course, the younger Douglas is a noted celebrity in his own right with an estimated net worth of $300 million.

In a move that at first blush seems surprising, it seems that most of Douglas’ wealth — $50 million — will pass to a charity he and his wife, Anne, founded — The Douglas Foundation 1964. That private foundation, in turn, benefits several other non-profit organizations including the Children’s Hospital of Los Angeles, a St. Lawrence University scholarship for underprivileged students, and the Kirk and Anne Douglas Childhood Center, among others. His famous son, Michael, reportedly will receive nothing from the estate. Of course, the younger Douglas is a noted celebrity in his own right with an estimated net worth of $300 million.

Creating Wills and Trusts, and updating those legal documents as life changes, can help ensure your wishes are honored when you die. If, like Kirk Douglas, you want to benefit charitable organizations at your death, planning ahead is the best way to make that goal a reality. Estate planning can also ensure your named beneficiaries, whether non-profit institutions or individuals, will benefit from your legacy the way you want them to, minimizing time and expenses related to estate settlement.

No matter what your estate planning goals are, The Estate Planning & Legacy Law Center can help. Contact us today to learn more and to schedule a consultation!