A Billionaire’s Fortune Was Lost Due to Cryptocurrency

January 25, 2022

How “The Daily” Podcast Documented A Euthanasia Journey

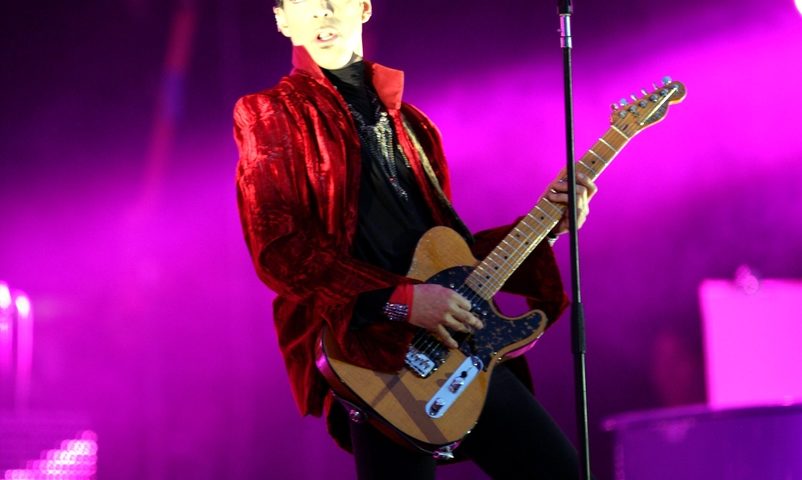

February 18, 2022After six long years of fighting in the courts, the value of Prince’s estate has finally been determined to be $156.4 million. Part of the reason it took so long to make this determination was because all the parties involved in settling the estate had to agree. Originally, they couldn’t come to terms on the total value of what Prince left behind.

Normally that would be done through a Will, but Prince died without one. That left the issue up to the courts to decide.

The IRS valued Prince’s estate at $163.2 million. Comerica Bank & Trust, the administrator of the estate, valued it much lower, at just $82.3 million. Naturally, those two amounts were so far apart that it wasn’t easy for everyone to reach an agreement. With the finalized amount, though, the distribution of the estate can finally get started.

Prince had six siblings, all of whom were considered heirs to his estate. Since his passing, two of those siblings have also died. Two of them are now in their 80s. The estate will be evenly divided between the New York music company Primary Wave, and the three oldest siblings, or their families if they’re no longer living. Of course, one or more parties to the agreement could still fight it. That would potentially delay the distribution from the estate for even longer, while additional legal issues are addressed and handled.

If Prince had died with a valid Will in place, this would not have been an issue. A Will can be challenged, but there would have to be grounds for that. In most cases a Will reduces or avoids problems with distribution of assets after death. It was startling that Prince would have died without a Will of any kind, given the amount of money and other assets he had. The singer passed away from an overdose of fentanyl in April 2016, when he was 57 years old.

Contact The Estate Planning & Legacy Law Center to learn more about estate planning and to start or update your own Will or Trust.