Estate Planning for Special Needs Beneficiaries

May 15, 2018How to Protect Your Digital Assets in Your Estate Plan

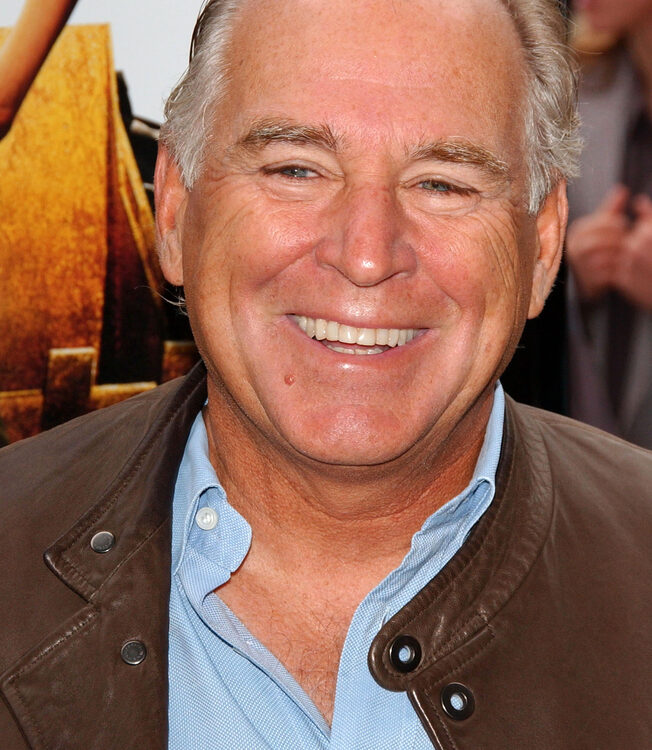

June 6, 2018It’s no secret that second or subsequent marriages can bring contentious relationships between the new spouse and children from previous relationships. When you factor in a sizable estate, those tensions that may have been simmering under the surface can easily escalate after a death. In the case of actor Alan Thicke who died in December 2016, his third wife, Tanya Callau, is engaged in a battle with his two adult sons from a previous marriage.

The sons, Robin and Brennan, are co-Trustees of Thicke’s Trust. As such, they are charged with managing the Trust estate according to the terms of the written Trust Agreement. In their role as co-Trustees, they also owe a fiduciary duty to the beneficiaries, including their step-mother.

Callau is claiming her step-sons have been reckless about spending inherited assets and that they are delinquent in distributing the share Thicke left for her. She is also allegedly claiming that charges against her share of Trust assets for taxes and expenses have been unfairly assessed. If Robin and Brennan are not forthcoming about how Trust assets have been managed and used, they may find themselves facing a legal challenge with their step-mother in court.

While one of the major benefits of using a Trust is that assets passing through the Trust will avoid the expense, hassle and publicity of probate court, Trust beneficiaries can still pursue litigation through the courts for breach of fiduciary duty.

When naming a Trustee or Executor for your estate, it is important to select people or professional fiduciaries you believe will honor your wishes and administer your Trust or Estate in a prudent and responsible manner. Sometimes naming a corporate trust department or other professional fiduciary may be the best solution to avoid unnecessary contention after your death. Your estate planning attorney can explain more about the trustee’s role and can help you understand potential benefits and drawbacks of various approaches, so you can make the best decision for you.

Estate planning helps you manage and secure your assets while you are alive. Careful planning can save money on court costs and reduce the anxiety surrounding your estate so that you can enjoy your life and focus on your family. Contact us today to learn more!