Broadway Legend Stephen Sondheim Left the Rights to His Music in a Trust

December 12, 2022

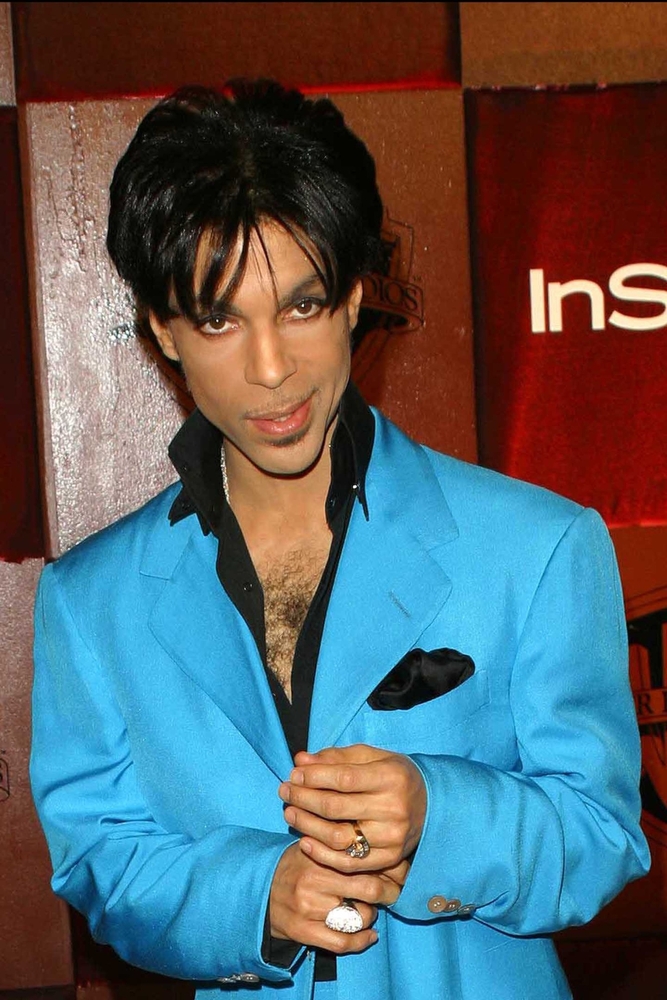

6 Years Later, Prince’s Estate Court Battle Ends

January 2, 2023A 401k is a great investment vehicle for many people who want to save for retirement. The vast majority of 401k dollars are invested into stocks, but some investors might want to see their retirement savings going into other options. Employers want to make sure they’re offering options, but they also need to be sure they’re providing opportunities that are safe and secure, so employees who participate aren’t at too much risk.

Every kind of investment carries some risk, but stocks and bitcoin, for example, are very different levels of risk. To offer alternative investments to 401k participants, employers will want to look at options that are fairly safe, such as REITs (Real Estate Investment Trusts).

These Trusts allow investors to purchase a stake in real estate, without having to buy the entire building. They have been used for more than 60 years and have developed a track record that most investors feel they can trust. They’re also being used in the benefit pension world, which means they can be a good alternative investment for companies that want to offer more than a 401k.

Private equity funds and hedge funds are also starting to be used more frequently for pension and retirement-based investments through employers, allowing employees to make choices about where their money is going and how they plan for their later years. Along with REITs and traditional types of stock and bond investing, these funds are typically pretty secure.

Where investments can go wrong is through offering options like ESG funds that are invested in bitcoin, art, and related areas. Their funds haven’t been around long enough to have a secure track record, and they can be very volatile for any investor, especially those who aren’t familiar with them. That makes them poor choices for alternative investments to the standard 401k, and it’s best to avoid offering them when safer and more protected investment vehicles are available.

Your estate planning attorney can provide information, recommendations, guidance, and assistance on funding your Trust, making you aware of potential tax considerations with various decisions and ensuring that each piece of your estate functions the way you intend. To learn more, contact The Estate Planning & Legacy Law Center today!