What You Need To Know About Digital Assets and Minor Children

February 26, 2019What do the College Admission Scandals Have to Do with Estate Planning?

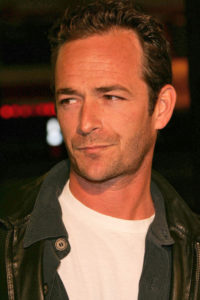

March 27, 2019All too often, we hear about celebrities who died without any type of estate plan in place, especially when a celebrity dies prematurely. When actor Luke Perry suffered a stroke and died unexpectedly a few days later at the age of 52, he fortunately did have some estate planning documents in place.

While the details haven’t been published, it is speculated that Perry had an advance health care directive in place providing authorization for his loved ones to end life support without the need to obtain a court order should there have been disagreement over his wishes. Advance directives can provide invaluable guidance and support for grieving family members in this type of situation, as loved ones have documentation to confirm the choices they make.

While the details haven’t been published, it is speculated that Perry had an advance health care directive in place providing authorization for his loved ones to end life support without the need to obtain a court order should there have been disagreement over his wishes. Advance directives can provide invaluable guidance and support for grieving family members in this type of situation, as loved ones have documentation to confirm the choices they make.

Perry also reportedly had a Will, created in 2015, leaving his estate to his two children. Those children, now ages 18 and 21, stand to inherit an unverified but estimated estate worth $10 million. It’s likely that Perry also had the foresight to create a Revocable Trust designed to protect his estate – and his children. If a Trust existed and if Perry’s assets were owned by the Trust (or passed to the Trust as the result of his death), then the public will likely never know the details of his estate. That’s because assets passing through properly funded Trusts are exempt from probate proceedings.

If Perry instead only had a Will, then details about his estate may be played out in the public sphere in the coming months as certain assets would need to go through probate court to pass to his heirs. One open question is whether Perry executed an amendment to his Will and/or Trust to include his fiancee. If she was not included, she will not have a legal right to claim a share of his estate because they hadn’t married yet at the time of Perry’s death.

The reality is that incapacity, or death, can strike any of us at any time. If you haven’t created your own estate planning documents yet, or if you have outdated documents that need to be updated to reflect your current situation and wishes, we can help. Contact us today to get started!