New Lawsuit Filed in Leonard Cohen Estate Battle

March 27, 2025

Pamela Bach Dies Without a Will

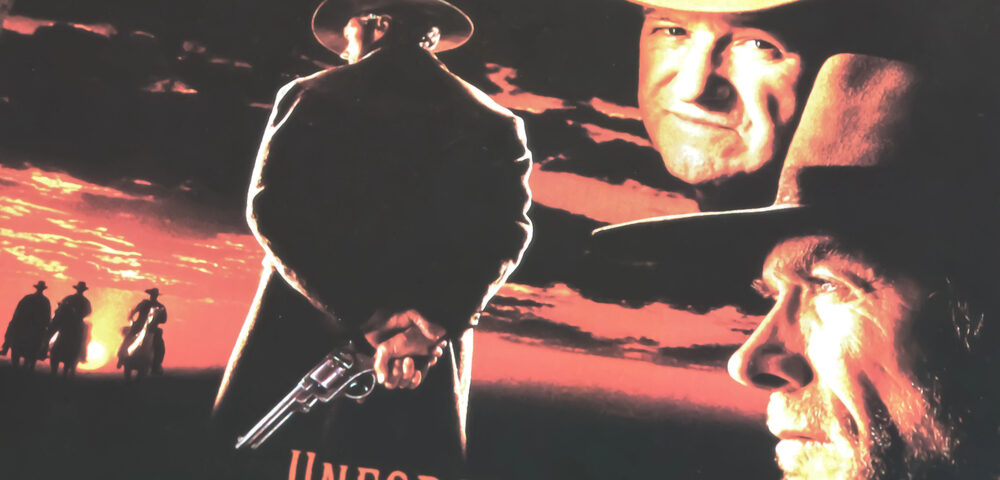

April 15, 2025A recent article reported that acclaimed actor Gene Hackman has allegedly excluded his children from his Will, a decision that’s capturing headlines and raising questions about his family dynamics.

According to the article, the two-time Oscar winner, who passed away in February at the age of 95, is believed to have opted for a very specific approach to his estate plan, choosing not to leave any inheritance to his three adult children. While the report doesn’t include a direct quote or official statement, sources close to the actor suggest that his decision is final and aligns with his personal values and long-held beliefs.

This revelation has sparked conversations around why individuals, famous or not, may choose to disinherit their children and what that means from a legal and emotional perspective.

Hackman isn’t the first celebrity to make headlines for disinheriting heirs. Ashton Kutcher and Mila Kunis have been open about not leaving their children an inheritance, even though their combined net worth is $275 million. Guy Fieri has also put stipulations in his estate plan regarding his children.

In Hackman’s case, some speculate that the move may reflect personal beliefs about financial independence, family relationships, or even previous support already given to his children during his lifetime. While the article doesn’t delve into the specifics, it does note that his choice appears to be a deliberate and legally sound one.

While estate plans are deeply personal, stories like this serve as a reminder of how important it is to have a clear, comprehensive, and legally binding plan in place. Whether someone chooses to divide their estate among children, leave assets to charity, or structure gifts in more nuanced ways, the key is clarity.

Gene Hackman’s estate decision is a high-profile example of how individualized estate planning can be. While not everyone will make the same choices, this story is a great reminder to review your plans regularly, communicate with your loved ones when appropriate, and work with a professional to ensure your intentions are clear and enforceable.

At The Estate Planning and Legacy Law Center, we work with clients every day to help them navigate these complex and often emotional decisions. We know that legacy planning is about more than just finances; it’s about reflecting your values, protecting your loved ones, and ensuring your wishes are honored.

If you’re ready to explore your options or revisit your estate plan, our team is here to guide you every step of the way!