Estate Planning Tips for Gen Zers and Millennials

December 9, 2022

How to Offer Alternative Investments to 401k Participants

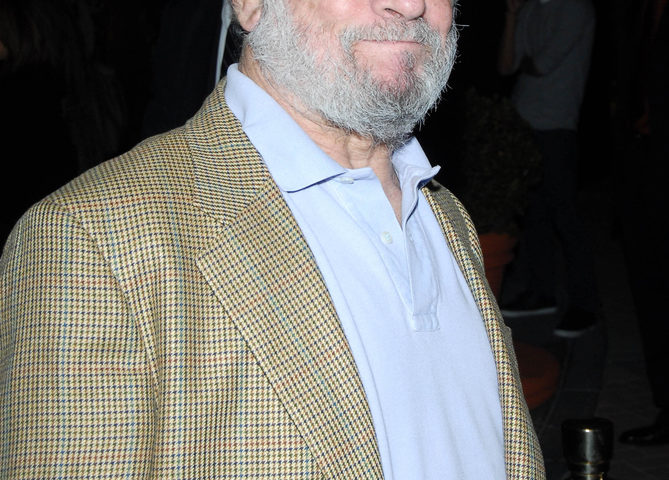

December 14, 2022Stephen Sondheim passed away the day after Thanksgiving in 2021, at 91 years of age. His estate was estimated to be worth somewhere around $75 million, and court papers now show that he left money to charities, his husband, and several friends. The rights to his literary works and music, along with his personal effects, were all designated to be placed into the Stephen J. Sondheim Revocable Trust.

Two men were named as executors of Sondheim’s estate, including a long-time friend who was also his attorney. His estate plan, said a source not connected with the case but familiar with estate law, will keep his husband and friends protected and benefit them. The charities he left money to will also benefit greatly from his generosity.

Having proper management of Sondheim’s musical legacy is extremely important, as his catalog of works is large and extremely valuable. It appears as though Sondheim was careful to create his estate plan, and ensure that his wishes would be carried out after his death. Everything will go into the Trust, and then money or other items designated for each person will be given from the Trust to those individuals.

The same will be true of the charities, where designated amounts will be passed to the organizations Sondheim named in his Will. This works well to make sure everyone is given what Sondheim wanted them to have, and that the Will is secure and not able to be contested. It’s a common estate planning technique, especially for those with considerable wealth.

Charities on the beneficiary list include the Smithsonian Institution, the Irish Repertory Theater Company, the Museum of New York City, and the Library of Congress, along with the New York Public Library for the Performing Arts and the Dramatists Guild Fund. Giving to these organizations will allow them to continue sharing music and literary works with generations to come.

Is your estate plan current and complete? For help ensuring your estate is administered the way you would want, contact The Estate Planning & Legacy Law Center today.