NFTs and Digital Currency Will Soon Be Used in Loyalty Programs

January 13, 2023

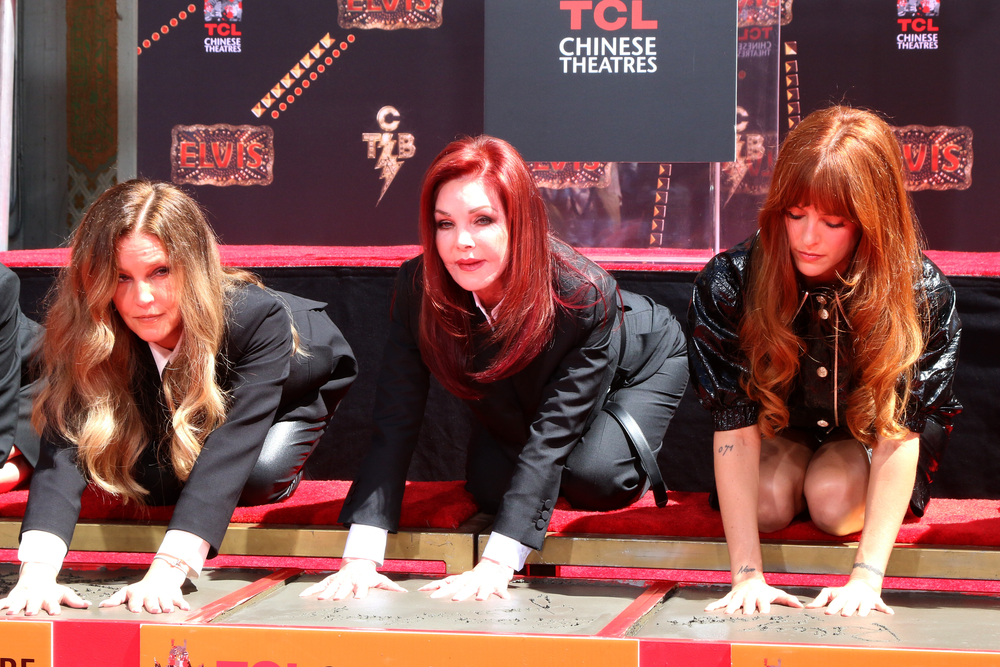

Details on Lisa Marie Presley’s Complicated Financial Legacy

January 30, 2023While anyone who wins the Mega Millions jackpot will probably start thinking about all the big things they can do with that money, a lottery lawyer weighing in on the money says taking the lump sum isn’t a good idea.

There are currently two different ways to get the money if you win this huge jackpot. One way is through a lump sum payment after taxes are taken out, and the other way is through an annuity, where you get a set amount of money every year for a period of time.

Most people who win big jackpots take the lump sum. They want to get all their money right away, and they don’t think too much about needing more in the future. After all, it’s millions of dollars. That’s more than they could ever spend, right? Unfortunately, it turns out that it’s pretty easy to spend millions of dollars, after all.

A lot of big lottery winners are broke within just a few years. Many others are robbed or even murdered by people trying to get at their money. The annuity option is a far better way to go when winning a large amount. Why? Because there’s a check coming in every year. Even if you overspend your first check with the excitement of having big money, more is on the way.

That means you can rely on having money every year, and you won’t accidentally spend so much that your lottery winnings don’t last. With an annuity and some investment, you can make sure you have all the money you need for the rest of your life, and even leave money to others.

Unless you’re really good at managing your money and have a proven track record of doing so, play it safe and get the annuity. With such a big jackpot you’ll still have plenty to spend, but you’ll be protecting your future, too.

No matter what your estate planning requirements may be, we are here for you. We will carefully listen to you to create an estate plan that meets your wishes and needs. We are dedicated to protecting your wealth and ensuring that your assets go to your intended beneficiaries. We specialize in Revocable Living Trusts, Pour-Over Wills, Powers of Attorney, Trust Administration and a range of other services. Contact us today to get started!